Return on Investment or ROI is the order of the day for most executives but it is also a feared term in many companies. The expectation to deliver measurable business outcomes can be felt so challenging that it makes people talk about everything except the economic value of their improvement proposal. Whether you like it or not; ROI measurement is going to continue being a key factor when deciding yes or no to a business process improvement initiative. Lower cost, higher revenue, reduced risk, less tied-up capital, greater availability, more flexibility, better margins, happier employees and more satisfied customers are fundamental ROI issues and measures.

Whether you like it or not; ROI measurement is going to continue being a key factor when deciding yes or no to a business process improvement initiative. Lower cost, higher revenue, reduced risk, less tied-up capital, greater availability, more flexibility, better margins, happier employees and more satisfied customers are fundamental ROI issues and measures.

These desired outcomes are not new; they have been core concerns since money first changed hands. Although these outcomes have stayed the same nearly everything else has changed, and then changed again. A technology that was revolutionary yesterday is now outdated. Companies must now achieve these ROI outcomes within a fierce and unforgiving economic environment unlike anything anyone has ever seen.

In this post, I will share a few ideas in the form of some targeted advice for achieving faster and greater ROI:

- Investments should be directed toward the best opportunity available. Avoid nostalgia. Investment decisions of the past must not be a roadblock for the investment decision of the present. Future expectations play a role – but the prospect that there may arrive a better solution in the future is uninteresting. Sure, there will be better solutions in the future.

- Achieving ROI require understanding that money has a time value. Profits to be generated in the future are less valuable than profits delivered today. Doing it right requires a point-of-decision perspective where resources are allocated to generate the best possible return as early as possible.

- ROI happens through purposeful change, which depends on people who are motivated, collaborative and communicative. No one can be a good change agent or teammate if left outside, uninformed. Therefore, the organization that cannot communicate cannot change, and the company that cannot change is endangered.

- Every ROI issue and measure must be itemized. Every one of them must be translated into money, then summarized and compared with the sum of the capital outlays to realize those ROI items.

Calculating the ROI of your Enterprise Investment

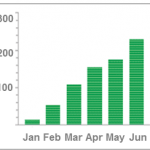

A complete ROI calculation must include the impact of cash flows that extend over the time. When an appropriate time increment (such as month) is chosen the ROI dividend for each increment is calculated as follows: ROI% = (business value – investment) / investment.

If the business value is K€100 and the investment is K€80 it generates a return of K€20 i.e., 25% ROI. Assuming this was for January and you continue accumulating the same value, but with only half the cost, for the rest of the year; your annual ROI would be 130%.

If the business value is K€100 and the investment is K€80 it generates a return of K€20 i.e., 25% ROI. Assuming this was for January and you continue accumulating the same value, but with only half the cost, for the rest of the year; your annual ROI would be 130%.

Successful software and transformation investments do not only providing ROI but also a great recurring pattern. The sooner you invest in a profitable solution the longer time you will enjoy the benefit of recurring returns on the investment. The payback from your initial investment is only part of the equation.